cryptocurrencies

Role of Network in Cryptocurrency Market Maturity

Cryptocurrency has revolutionized the way we think about money and financial markets. With the development of blockchain technology, cryptocurrencies are now being used as a way to store and transfer value. But what role do networks play in the maturity of the cryptocurrency market? In this post, we will discuss this topic and explore the power of networks in cryptocurrency markets. We will look at how networks can help create a more mature and stable market, and how they can help to protect against fraud and manipulation. By the end of this post, you should have a better understanding of the role of networks in the cryptocurrency market and how they can help to ensure its long-term success.

Read More Article: Dennis Loos Expert Instaguru

Cryptocurrency Revolution

Cryptocurrency markets are booming – and for good reason. Digital assets such as Bitcoin, Ethereum, and Litecoin have seen tremendous growth in recent years, and there are plenty of reasons to believe that the cryptocurrency revolution is only just getting started.

One big reason for this growth is the growth of digital asset markets. These markets allow people to buy and sell cryptocurrencies without needing to worry about currency exchange rates or dealing with complicated financial processes. This has made cryptocurrency more accessible to a wider audience, which in turn has helped to drive further growth.

Another important factor in the cryptocurrency revolution is the role that networks play. Cryptocurrencies are built on networks of users who trust each other to keep transactions safe and secure. With each new transaction, these networks become more stable and reliable – a key requirement for any successful market economy.

As blockchain technology continues to evolve, it is fueling new types of investment vehicles in the crypto space. For example, decentralized exchanges (DEXs) let people trade cryptocurrencies without having to go through a centralized third party like an exchange desk or brokerage house. This opens up opportunities for investors who want access to a wider range of cryptocurrencies without having to worry about security risks or high fees associated with traditional exchanges.

Meanwhile, advances in blockchain technology are also opening up new possibilities for smart contracts and decentralized applications (DApps). These tools can be used to automate complex business processes or interact with third-party services securely and transparently through blockchain technology alone – removing the need for middlemen altogether! All of these advances are driving challenges and opportunities in the crypto space – but they also hold immense potential for financial inclusion worldwide.

The Power of Networks in Cryptocurrency Markets

Cryptocurrency markets are booming, and there’s no doubt that networks are playing a big role in driving this growth. Network effects help to fuel price volatility and legitimize the market. Social media and peer-to-peer networks play a critical role in this process by helping to legitimize the market. In addition, more participants are joining the market which has led to an increase in liquidity. Decentralized networks allow for more access to global resources, creating more opportunities for innovation.

Read To Learn More Info: Cryptocurrency Networking-How to Connect with Like-Minded People

Cryptocurrency networks also facilitate global community engagement. For example, by allowing people from all over the world to participate in the network, creates a sense of community that encourages people to invest in and support cryptocurrencies. This increased engagement has also led to increased security and privacy with the use of cryptography in these networks. Overall, cryptocurrency networks have had a profound impact on traditional payment processing systems and created new opportunities for secure transactions across borders.

Understanding Network Effects Within Cryptocurrency Markets

Cryptocurrencies are a new and exciting form of currency. They’re based on blockchain technology, which is a distributed database that allows for secure, transparent, and tamper-proof transactions. Cryptocurrencies are built on a network of users who help to maintain the integrity of the system by validating and recording transactions. This network effect is one of the key drivers behind their success – it’s essential for cryptocurrencies to have a robust network in order to be successful.

Network effects play an important role in shaping trading strategies and decision-making in cryptocurrency markets. When there are more users involved in a system, it becomes more difficult for one party to disrupt or control that system. This increases the value of the system as more people use it, creating powerful incentives for participants to join up and create a strong network.

Understanding how network effects work is essential when trading cryptocurrencies – it can help you identify opportunities before they occur, assess the risk appropriately, and make informed decisions about where to invest your time and money. In addition, having a strong network effect can help cryptocurrencies become more mature and stable over time, reducing the risk associated with investing in them.

Miner participation is another key driver of cryptocurrency networks – without miners participating in the validation process, there would be no way to establish consensus on which blocks are valid and which transactions should be accepted by the network. Miners play an important role in driving network effects by ensuring that all transactions are recorded accurately so that everyone can agree upon the state of the system. This helps to protect against fraud or attempts at manipulation by individual players within the ecosystem.

Finally, understanding how network effects impact liquidity and transaction costs is essential if you want to trade cryptocurrencies successfully. As networks grow larger and more diverse, it becomes increasingly difficult for buyers and sellers to find each other without incurring significant costs along the way (such as fees). By understanding these dynamics ahead of time, you can make informed decisions about where best to invest your time and money when trading cryptos.

To Summarize

The importance of networks in cryptocurrency markets cannot be overstated. Networks are essential for the success of digital assets, providing security and stability while also helping to drive innovation. By understanding how networks work, investors can gain a better understanding of the market dynamics and make informed decisions about where to invest their time and money. As cryptocurrency markets continue to mature, networks will play an increasingly important role in ensuring their long-term success – so it is essential for investors and traders to understand how these networks function.

Artifiсiаl Intelligenсe

Beyond Passwords: Your Digital Self in the Age of Blockchain (Clickbait: Ditch Passwords Forever! This Tech Will Secure Your Online Life)

Beyond Passwords: Your Digital Self in the Age of Blockchain (Clickbait: Ditch Passwords Forever! This Tech Will Secure Your Online Life)

Tired of password Purgatory? Enter the Blockchain Oasis.

Remember that frantic morning scramble, brain aching for the elusive password to your bank account?

Or the sinking feeling when “incorrect password” flashes back, mocking your best guess?

We’ve all been there, prisoners of our own digital fortresses, locked out by the very keys meant to protect us. But what if we told you there’s a better way, a passwordless paradise called blockchain technology?

Think of it as your digital Swiss bank account, secure and impregnable.

Unlike the flimsy walls of traditional passwords, easily breached by hackers and cracked by brute force, blockchain builds fortresses with ironclad cryptography.

Your data, from medical records to online purchases, isn’t hoarded by corporations or vulnerable to centralized attacks.

Instead, it lives on a distributed ledger, a communal vault encrypted across thousands of computers, each one a guardian vigilantly watching over your digital self.

This isn’t just about convenience (though ditching those sticky notes is a major perk!). This is about ownership and control.

Blockchain empowers you to be the gatekeeper of your digital life. You decide what information you share, with whom, and for how long.

No more Big Brother data slurping or shady companies monetizing your privacy. You become the sovereign ruler of your own digital kingdom, wielding the keys to unlock or deny entry.

Imagine accessing your healthcare records without divulging them to every hospital you visit.

Picture transferring money across borders, instantly and securely, without banks taking a hefty cut.

Envision a world where your online identity isn’t a mosaic scattered across corporate servers, but a unified passport you carry with pride, granting access to services based on your own terms.

This is the promise of blockchain: a future where security isn’t a fragile wall of passwords, but a vibrant ecosystem of trust and empowerment.

Are you ready to leave Password Purgatory behind and step into the Blockchain Oasis? Buckle up, savvy internet user, because the revolution has just begun.

The Downside of Traditional Passwords

Why Are Passwords Failing Us?

In our digital age, passwords are the guardians of our online identities, yet they are failing us in more ways than one. Despite being the first line of defense in digital security, traditional passwords are increasingly becoming the weakest link. Let’s explore why.

The Illusion of Strength in Complexity

Think of the last time you created a password. Chances are, you were prompted to include a mix of letters, numbers, and symbols – the more complex, the better, right?

However, this complexity often leads to passwords that are hard to remember and, ironically, not as secure as we think. Cybersecurity experts have long debunked the myth that complexity equates to security.

In reality, it’s the length and unpredictability of passwords that matter most. But even then, no password is impervious to the sophisticated tactics employed by hackers today.

The Human Factor: Password Fatigue and Security Risks

As humans, we have our limits in remembering complex strings of characters. This leads to password fatigue – the tendency to reuse passwords across multiple accounts for convenience.

It’s like using the same key for your house, car, and office; if one gets lost or stolen, everything is compromised. This common practice significantly heightens the risk of mass data breaches.

Once a hacker cracks one password, they potentially gain access to an entire suite of an individual’s personal and professional digital life.

The Hacker’s Playground: Vulnerabilities in Password-Based Security

Hackers have a plethora of tools at their disposal to breach password-protected accounts. Techniques like brute force attacks, where automated software tries countless combinations until it finds the right one, are surprisingly effective against weak passwords.

Phishing attacks, where users are tricked into revealing their passwords, are increasingly sophisticated and difficult to spot.

Even when we think our passwords are safely stored, large-scale data breaches at major companies reveal that this is not always the case.

The Cost of Password Management and Recovery

The administrative burden of managing and recovering passwords is another often-overlooked downside.

For businesses, the cost of resetting passwords and dealing with security breaches can be astronomical.

For individuals, the time and effort spent managing passwords, coupled with the anxiety of keeping them safe, are a significant mental burden.

Biometric Authentication: A Step Forward but Not a Panacea

The advent of biometric authentication – using fingerprints, facial recognition, or retinal scans – seemed like a promising solution.

However, while biometrics offer convenience, they are not without their flaws. Biometric data, once compromised, cannot be changed like a password.

There are also privacy concerns and the potential for misuse of biometric data by corporations or governments.

Looking Beyond Passwords: The Need for a Paradigm Shift

The limitations of traditional passwords highlight the need for a paradigm shift in digital security.

We need a solution that is both secure and user-friendly, something that doesn’t require us to remember complex strings of characters or put our personal biometrics at risk.

This is where blockchain technology comes into play, offering a new way to authenticate identities and secure data without the pitfalls of traditional passwords.

Conclusion

In conclusion, while passwords have been the cornerstone of digital security for decades, their numerous shortcomings are increasingly apparent in our connected world.

As cyber threats evolve, so must our approach to securing our digital lives.

The future of digital security lies in innovative technologies like blockchain, which promise to offer a more secure, efficient, and user-centric approach to protecting our digital identities.

Blockchain: The Game-Changer in Digital Security

How Does Blockchain Enhance Security?

In the digital world, where data breaches and cyber threats loom large, blockchain emerges as a beacon of hope, promising a more secure and trustworthy online environment.

But what exactly makes blockchain a game-changer in digital security? Let’s unpack this.

The Immutable Ledger: A Foundation of Trust

At its core, blockchain is a distributed ledger technology. Imagine a ledger that is not maintained by a single entity but is spread across a network of computers, each holding a copy of the ledger.

This decentralization is key to blockchain’s power. Once a record is added to the blockchain, altering it is next to impossible.

This immutability provides a foundation of trust and security unprecedented in digital transactions.

Decentralization: The Antidote to Centralized Risk

Centralization in traditional digital systems creates a single point of failure, a treasure trove for cybercriminals. Blockchain disrupts this by distributing data across a vast network, thereby diluting the risk.

Even if a part of the network is compromised, the rest remains unscathed, preserving the integrity of the entire system.

Cryptography: The Art of Secret Keeping

Blockchain employs advanced cryptography to secure the data.

Each block in the chain is secured with a cryptographic hash, a mathematical algorithm that turns data into a unique string of characters. Any change in the data alters the hash dramatically.

This means that tampering with a block would require altering all subsequent blocks, an almost Herculean task given the computational power required.

Transparency and Anonymity: A Balancing Act

Blockchain strikes a unique balance between transparency and anonymity.

While all transactions are visible to everyone in the network, the identities of the parties involved are protected.

This transparency ensures accountability and trust, while anonymity safeguards user privacy.

Smart Contracts: The Protocols of Trust

Smart contracts, self-executing contracts with the terms of the agreement directly written into code, are a revolutionary aspect of blockchain.

They automate and enforce contractual obligations, reducing the need for intermediaries and the risk of fraud or manipulation.

Beyond Cryptocurrency: Diverse Applications of Blockchain in Security

Blockchain’s potential extends far beyond the realms of cryptocurrency.

In digital identity verification, it offers a secure way to manage and authenticate identities without centralized databases.

In supply chain management, it ensures the authenticity and traceability of products. In voting systems, it can provide secure and transparent electoral processes.

Challenges in Blockchain Adoption

Despite its potential, blockchain’s adoption faces hurdles.

Scalability, energy consumption, and the integration with existing systems are significant challenges. Furthermore, regulatory uncertainties and a lack of widespread understanding of the technology hinder its broader acceptance.

Preparing for a Blockchain-Enabled Future

As we stand on the brink of a blockchain revolution in digital security, it’s essential to educate ourselves about this technology.

Businesses and individuals alike must stay informed about the latest developments in blockchain and explore how it can be integrated into their digital practices.

Conclusion

Blockchain technology offers a new paradigm in digital security, promising a more secure, transparent, and efficient way to safeguard digital assets and identities.

As we move forward, embracing this technology and overcoming its challenges will be key to building a safer digital world.

The Mechanics of Blockchain Security

Understanding the Nuts and Bolts

Blockchain security is often hailed as a groundbreaking innovation, but how does it really work? What makes it so secure and reliable?

Let’s dive into the mechanics of blockchain security and understand what sets it apart.

The Anatomy of a Blockchain

Picture a blockchain as a series of digital ‘blocks’ linked together in a chain.

Each block contains a set of transactions or data, securely encrypted.

Every time a new block is added, it is verified by multiple nodes (computers) in the network, making fraud or alteration extremely difficult.

The Power of Decentralization

Decentralization is the heartbeat of blockchain security.

Unlike traditional systems where data is stored on central servers, blockchain distributes data across a network of nodes.

This means there’s no single point of failure, making it incredibly resistant to cyber-attacks and data breaches.

Cryptography: The Backbone of Blockchain Security

Blockchain uses advanced cryptographic techniques. Each block contains a unique cryptographic hash of the previous block, creating a secure link.

Altering any information would change the hash, alerting the network to the tampering. This cryptographic chaining ensures the integrity and chronological order of the blockchain.

Consensus Protocols: Ensuring Network Agreement

Blockchain operates on consensus protocols, rules that dictate how transactions are verified and added to the block.

Popular protocols like Proof of Work (PoW) and Proof of Stake (PoS) ensure that all nodes in the network agree on the state of the ledger, preventing fraudulent transactions.

Smart Contracts: Automating Trust

Smart contracts on the blockchain automatically execute transactions when predetermined conditions are met.

These contracts run on code and eliminate the need for intermediaries, reducing the risk of manipulation and increasing efficiency.

Challenges and Limitations

Despite its strengths, blockchain isn’t without challenges.

Issues like scalability, energy consumption (especially with PoW), and integrating blockchain into existing systems remain significant hurdles.

There’s also the concern of ‘51% attacks’ in some blockchains, where if more than half the network’s computing power is controlled by one entity, they could potentially manipulate the network.

Conclusion

Blockchain security offers a robust and innovative approach to protecting digital information.

Its combination of decentralization, cryptography, and consensus protocols provides a level of security far beyond traditional methods.

As the technology matures and overcomes its current limitations, blockchain stands to revolutionize how we secure our digital world.

Blockchain vs. Passwords: A Comparative Analysis

Why Blockchain Wins

In the digital security arena, blockchain and traditional passwords represent two very different philosophies.

While passwords have been the cornerstone of digital security for decades, blockchain introduces a paradigm shift.

Let’s compare these two to understand why blockchain is emerging as the superior option.

Traditional Passwords: The Aging Security Guard

Think of traditional passwords as an aging security guard. They’ve been around for a long time, are familiar, but they’re not as effective as they used to be.

Passwords are vulnerable to a range of attacks – from brute force to phishing – and they rely heavily on human memory and behavior, which can be fallible.

Blockchain: The Digital Fort Knox

On the other hand, blockchain can be likened to a digital Fort Knox. It doesn’t rely on single-key entry like passwords.

Instead, it offers a distributed, immutable ledger with complex cryptographic techniques.

This makes blockchain inherently more secure, as altering any part of the chain would require an astronomical amount of computing power.

User Experience: Complexity vs. Simplicity

One of the biggest drawbacks of passwords is their complexity and the user fatigue they cause. In contrast, blockchain can streamline the user experience.

With blockchain, users can potentially have a single digital identity for multiple platforms, eliminating the need to remember numerous passwords.

Decentralization: Eliminating Single Points of Failure

Passwords often involve centralized databases, creating single points of failure. Blockchain distributes data across a vast network, significantly reducing this risk.

Even if a part of the network is compromised, the rest remains secure, safeguarding the overall integrity.

Recovery and Revocation: A Clear Winner

Losing a password can lead to a cumbersome recovery process. Blockchain offers a more resilient approach.

For instance, with decentralized identity solutions, users can recover their identity through distributed mechanisms, without relying on a central authority.

Scalability and Adoption Challenges

Despite its advantages, blockchain faces its own set of challenges, particularly in scalability and widespread adoption.

Integrating blockchain into existing systems and ensuring it can handle large volumes of transactions are areas that need addressing.

Conclusion

Comparing blockchain with traditional passwords illustrates why blockchain is poised to be the future of digital security.

Its decentralized nature, enhanced security features, and user-friendly potential make it a formidable tool against cyber threats.

As blockchain technology overcomes its current challenges, it could render traditional passwords obsolete, ushering in a new era of digital security.

Real-World Applications of Blockchain in Security

Blockchain in Action

The realm of blockchain extends far beyond the confines of cryptocurrency.

Its unique attributes are being harnessed in various sectors, revolutionizing the way we think about and implement digital security.

Let’s explore some of the most impactful real-world applications of blockchain technology.

Revolutionizing Digital Identity Verification

One of the most significant applications of blockchain is in digital identity verification.

Traditional methods of identity verification are fraught with risks – from data breaches to identity theft.

Blockchain introduces a decentralized approach, where users can control their digital identities without relying on a central authority. This method not only enhances security but also offers greater privacy and control to individuals.

Transforming Supply Chain Management

In supply chain management, blockchain is a game-changer.

It provides a transparent and tamper-proof record of transactions and movements of goods.

This transparency ensures the authenticity of products, combats counterfeit goods, and enhances trust among consumers and businesses alike. From farm to table or manufacturer to retailer, every step is verifiable and secure.

Secure Voting Systems

Blockchain is making strides in securing electoral processes.

By leveraging blockchain, voting systems can become more secure, transparent, and resistant to tampering. This application could revolutionize democracy, making elections more accessible and trustworthy.

Healthcare Data Management

In healthcare, blockchain can securely manage patient records, ensuring privacy and data integrity.

It provides a secure platform for sharing medical records between authorized individuals and institutions, improving the efficiency and accuracy of diagnoses and treatments.

Challenges and Considerations

While these applications are promising, challenges such as scalability, regulatory compliance, and integration with existing systems remain.

There is also a need for a broader understanding and acceptance of blockchain technology among the general public and within specific industries.

Conclusion

The real-world applications of blockchain in security demonstrate its potential to revolutionize how we manage and protect digital information.

As the technology evolves and these challenges are addressed, blockchain is set to play a pivotal role in shaping a more secure and efficient digital world.

Overcoming the Challenges of Implementing Blockchain

Tackling the Obstacles

Blockchain technology, despite its potential, is not without its challenges.

Implementing blockchain in existing systems and processes requires navigating a complex landscape of technical, regulatory, and practical hurdles.

Let’s delve into these challenges and explore how they can be overcome.

Scalability: The Growing Pains of Blockchain

One of the primary challenges facing blockchain is scalability.

As the number of transactions on a blockchain increases, so does the need for greater computational power and storage.

This can lead to slower transaction times and higher costs, making it less practical for large-scale applications.

Solutions like sharding, where the blockchain is divided into smaller, more manageable pieces, and layer 2 solutions that process transactions off the main chain, are being explored to address this issue.

Energy Consumption: A Sustainable Dilemma

Blockchain, especially those using Proof of Work (PoW) consensus mechanisms, can be energy-intensive.

This raises concerns about the environmental impact of blockchain technologies.

Transitioning to more energy-efficient consensus mechanisms like Proof of Stake (PoS) or exploring renewable energy sources for mining operations are ways to mitigate this issue.

Regulatory Hurdles: Navigating the Legal Landscape

The decentralized and often borderless nature of blockchain poses significant regulatory challenges. Different countries have varying regulations regarding digital transactions, data privacy, and cryptocurrency.

Ensuring compliance while fostering innovation requires a delicate balance and ongoing dialogue between technology providers, users, and regulatory bodies.

Integration with Existing Systems

Integrating blockchain technology with existing digital infrastructures can be complex. Compatibility issues, the need for technical expertise, and the disruption of established processes can pose significant barriers.

Developing user-friendly blockchain solutions and providing education and training can facilitate smoother integration.

Security Concerns: Addressing Vulnerabilities

While blockchain is inherently secure, it is not immune to risks.

Potential security issues, such as 51% attacks, smart contract vulnerabilities, and key management challenges, need to be addressed.

Continuous research and development, alongside robust security protocols, are essential to bolster blockchain security.

Conclusion

Overcoming the challenges of implementing blockchain is crucial for realizing its full potential.

This involves addressing scalability and energy consumption issues, navigating regulatory landscapes, integrating with existing systems, and bolstering security measures.

As we tackle these obstacles, blockchain’s promise in transforming digital security becomes increasingly attainable.

The Future of Blockchain in Personal Security

What Lies Ahead

The horizon of personal security is being redrawn by blockchain technology.

As we edge further into the digital era, blockchain is poised to play a critical role in shaping our digital identities and safeguarding our online activities.

Let’s explore the promising future of blockchain in personal security.

Blockchain as a Guardian of Digital Identities

Imagine a world where your digital identity is as unique and unforgeable as your DNA.

Blockchain makes this possible. With its ability to create tamper-proof digital identities, blockchain is setting the stage for a future where identity theft and fraud become relics of the past.

These blockchain-based identities could replace traditional login credentials, offering a more secure and convenient way to access online services.

Enhanced Privacy and Control Over Personal Data

In an age where data breaches are commonplace, blockchain offers a beacon of hope. It empowers individuals with greater control over their personal data.

Instead of entrusting personal information to multiple organizations, blockchain allows individuals to store their data securely and share it selectively, using cryptographic keys.

Decentralized Finance (DeFi) and Personal Wealth Management

The rise of decentralized finance (DeFi) is another area where blockchain is set to transform personal security. By removing intermediaries, DeFi platforms offer more control and security over personal financial transactions.

Blockchain’s transparency and security features make it an ideal backbone for these platforms, promising a more secure and equitable financial ecosystem.

Challenges and Opportunities in Personal Security

The journey towards a blockchain-powered future is not without challenges.

Issues like public acceptance, technological literacy, and regulatory frameworks need to be addressed.

However, these challenges also present opportunities for innovation, collaboration, and education in the realm of personal security.

Conclusion

As blockchain technology matures, its potential to redefine personal security is immense.

From securing digital identities to revolutionizing personal finance, blockchain stands as a pillar of trust and security in the digital world.

Embracing this technology could lead us to a future where our digital lives are more secure, private, and under our control.

How to Prepare for the Blockchain Revolution

Getting Ready for Change

The blockchain revolution is not just coming; it’s already here. But how do we prepare for this seismic shift in digital security?

Whether you’re an individual, a business leader, or a technology enthusiast, gearing up for the blockchain era requires a proactive approach. Here’s how to get ready.

Educating Yourself and Your Team

Knowledge is power, especially when it comes to emerging technologies. Start by educating yourself about blockchain technology.

Online courses, webinars, and industry conferences are great resources. If you’re leading a team or an organization, consider facilitating blockchain training sessions to stay ahead of the curve.

Evaluating Blockchain Applications in Your Life or Business

Look at how blockchain could apply to your personal life or your business operations.

This might involve exploring blockchain-based solutions for data storage, identity verification, or even investment opportunities in the blockchain space.

Participating in Blockchain Communities and Networks

Engagement with blockchain communities can provide invaluable insights and keep you updated on the latest trends and developments.

Online forums, social media groups, and local meetups can serve as platforms for discussion and networking.

Experimenting with Blockchain Technologies

Hands-on experience is one of the best ways to understand blockchain.

Consider experimenting with blockchain applications, such as using a blockchain-based service or investing in cryptocurrencies.

This practical exposure can demystify the technology and reveal its potential applications in your life.

Understanding the Regulatory Landscape

Stay informed about the regulatory environment surrounding blockchain technology, especially if you’re considering it for business applications.

Keeping abreast of legal and compliance issues is crucial to navigating the blockchain space successfully.

Conclusion

Preparing for the blockchain revolution involves education, experimentation, and engagement with the blockchain community.

By taking these steps, individuals and businesses can position themselves to harness the benefits of blockchain technology and navigate the challenges it presents.

The future belongs to those who are ready to embrace change and innovate, and blockchain is a field ripe with opportunities for both.

Debunking Myths about Blockchain Security

Separating Fact from Fiction

Blockchain technology, while revolutionary, is often shrouded in myths and misconceptions, especially regarding its security aspects.

It’s crucial to separate fact from fiction to understand the true capabilities and limitations of blockchain security. Let’s debunk some common myths.

Myth 1: Blockchain is Inherently Invulnerable

Fact: While blockchain’s design makes it highly secure, it’s not infallible. Issues like code vulnerabilities in smart contracts and potential 51% attacks on certain types of blockchains can pose risks.

However, compared to traditional databases, blockchain’s decentralized and cryptographic nature makes it significantly more secure against common cyber threats.

Myth 2: All Blockchains are Public and Transparent

Fact: Not all blockchains are created equal.

While public blockchains offer transparency and decentralization, private blockchains control access more strictly, offering privacy and efficiency.

The choice between public and private blockchains depends on the specific needs and context of use.

Myth 3: Blockchain and Cryptocurrency are Interchangeable

Fact: Cryptocurrencies like Bitcoin are just one application of blockchain technology.

Blockchain has a myriad of other applications beyond digital currencies, from supply chain management to digital identity verification.

Myth 4: Blockchain Transactions are Always Anonymous

Fact: Anonymity in blockchain transactions varies. While cryptocurrencies like Bitcoin offer a degree of anonymity, other blockchains provide full transparency.

Moreover, advanced techniques can sometimes trace blockchain transactions, challenging the notion of absolute anonymity.

Myth 5: Blockchain is a Data Privacy Solution

Fact: Blockchain can enhance data security, but it doesn’t automatically guarantee data privacy.

The way data is recorded and encrypted on the blockchain plays a crucial role in determining privacy levels.

Conclusion

Understanding the realities of blockchain security is vital for its effective implementation and trust.

By debunking these myths, we can appreciate the true potential and limitations of blockchain, paving the way for informed and effective use of this transformative technology.

The Ultimate Guide to Blockchain Security Tools

Your Toolkit for the Future

As blockchain technology becomes increasingly prevalent, the importance of understanding and utilizing blockchain security tools grows.

Whether you’re a blockchain enthusiast, a business professional, or someone curious about the technology, having a grasp of these tools is essential.

Here’s a guide to some key blockchain security tools.

Cryptographic Wallets: Secure Storage for Digital Assets

Cryptographic wallets are essential for securely storing and managing digital assets like cryptocurrencies.

They use private keys, a form of cryptography, to enable users to access and transact their assets securely.

Choosing a reputable wallet, whether it’s a software, hardware, or paper wallet, is crucial for asset security.

Smart Contract Auditing Tools

As smart contracts become more complex, the need for thorough auditing increases.

Tools like Mythril and OpenZeppelin provide security analysis of smart contracts, identifying vulnerabilities and ensuring that they behave as intended.

Blockchain Explorers: Tracking Transactions

Blockchain explorers are tools that allow users to view and track transactions on a blockchain.

They offer transparency and the ability to verify transactions, which is crucial for trust and security in blockchain ecosystems.

Decentralized Identity Applications

Decentralized identity applications use blockchain to provide users with more control over their personal information.

These tools are foundational for creating secure digital identities and can be used for authentication purposes without the need for centralized databases.

API Security Tools

APIs are vital for blockchain applications, and securing them is paramount.

Tools like OAuth 2.0, OpenID Connect, and API gateways help secure and manage access to blockchain-based APIs, protecting against unauthorized access and data breaches.

Conclusion

The landscape of blockchain security tools is vast and evolving. Familiarizing oneself with these tools is a step towards harnessing the full potential of blockchain technology.

As blockchain continues to grow and integrate into various sectors, these tools will become instrumental in securing and optimizing blockchain applications.

Final Conclusion

As we journey through the intricate world of blockchain technology and its impact on digital security, it becomes evident that we are standing on the brink of a major technological revolution.

From debunking myths about blockchain security to exploring an array of advanced security tools, our expedition reveals a future where blockchain is poised to redefine the norms of digital safety and privacy.

This transformative technology, with its decentralized nature, cryptographic security, and innovative applications, offers more than just a new way to secure digital transactions; it promises a future where our digital identities and assets are protected with unprecedented robustness.

Embracing blockchain, understanding its potential, and preparing for its widespread adoption are crucial steps towards a safer, more secure digital world.

As we continue to explore and innovate in this exciting field, the possibilities for enhanced digital security seem limitless.

FAQs

Is blockchain technology applicable in everyday life, or is it just for tech experts?

Blockchain technology is increasingly becoming applicable in everyday life, not just for tech experts. Its applications range from secure online transactions and digital identity management to supply chain tracking and voting systems, making it relevant and beneficial for the general public.

Can blockchain be used to secure all kinds of digital data, or is it limited to financial transactions?

Blockchain can secure various kinds of digital data, not just financial transactions. Its applications include securing personal data, healthcare records, digital identities, and more, demonstrating its versatility beyond just financial uses.

How does blockchain technology offer more security compared to traditional security methods?

Blockchain technology offers more security through its decentralized structure, which eliminates single points of failure, and its use of advanced cryptography, which ensures data integrity and prevents unauthorized alterations.

Are there any significant environmental concerns associated with blockchain technology?

Yes, certain blockchain implementations, particularly those using Proof of Work (PoW) consensus mechanisms, can be energy-intensive and raise environmental concerns. However, newer technologies like Proof of Stake (PoS) are more energy-efficient and are being adopted to address these concerns.

How can individuals ensure they are using blockchain technology safely and effectively?

Individuals can ensure safe and effective use of blockchain technology by educating themselves about its basics, using reputable blockchain services and wallets, staying informed about security best practices, and being cautious of scams and fraudulent schemes in the blockchain space.

Verified Source References

- Blockchain Technology Fundamentals: IBM Blockchain Essentials

- Understanding Cryptographic Wallets: Investopedia – Cryptocurrency Wallets

- Guide to Smart Contract Auditing Tools: Ethereum Smart Contract Best Practices

- Blockchain Explorers and Their Use: Blockgeeks – Blockchain Explorers

- Decentralized Identity Applications in Blockchain: Decentralized Identity Foundation

cryptocurrencies

Busting Myths: Can You REALLY Make Money in Axie Infinity’s Metaverse?

Busting Myths: Can You REALLY Make Money in Axie Infinity‘s Metaverse?

Ah, Axie Infinity. The once-obscure blockchain game that transformed into a pop culture phenomenon, spawning Axie millionaires and igniting a frenzy for all things “play-to-earn.”

But with the hype comes the inevitable skepticism. Can you really make money in Axie Infinity’s metaverse, or is it just a digital mirage shimmering in the crypto-desert?

Strap in, fellow adventurers, because we’re about to bust some Axie-sized myths and uncover the gritty reality of earning in this virtual wonderland.

Myth #1: Axie Infinity is a cash-grab pyramid scheme.

Ah, the dreaded “pyramid scheme” accusation.

Let’s address this head-on. Yes, Axie Infinity has elements of a network marketing system, where early players benefit from onboarding new Axie trainers.

But unlike a true pyramid scheme, Axie’s value isn’t solely dependent on constant recruitment.

Think of Axies as Pokemon crossed with digital real estate. Each Axie is a unique NFT (non-fungible token) with distinct genes and battle capabilities.

Their value fluctuates based on demand, breeding potential, and in-game performance. So, even if player recruitment slows down, Axies themselves can retain value due to their inherent utility and collectability.

Myth #2: You need a small fortune to get started.

While it’s true that the initial cost of purchasing an Axie has skyrocketed (some costing thousands of dollars!), Axie Infinity’s scholarship program offers a glimmer of hope.

Scholarships pair experienced players with “scholars” who borrow Axies to play and compete, sharing a percentage of their earnings.

It’s not a get-rich-quick scheme, but it’s a fantastic way to test the waters without breaking the bank.

Myth #3: All you do is grind battles and earn easy crypto.

Okay, let’s dispel this fantasy right now.

Axie Infinity isn’t some passive income machine where you click buttons and watch the crypto roll in. It’s a strategy game with a steep learning curve.

Mastering Axie breeding, team composition, and battle tactics takes time, dedication, and a healthy dose of skill. Think of it like any other competitive career – success requires hard work, strategic thinking, and a bit of luck.

But wait, there’s more!

We’ve only scratched the surface of Axie Infinity’s earning potential. Buckle up for deeper dives into:

- Land Ownership: Own a piece of Lunacia, Axie’s virtual land, and reap the rewards of resource harvesting, Axie breeding bonuses, and community events.

- Breeding and Marketplace Mastery: Craft coveted Axies with high battle potential, then flip them for handsome profits on the Axie marketplace.

- Content Creation and Community Building: Share your Axie expertise through streams, tutorials, and guides, attracting sponsorships and loyal followers.

Is Axie Infinity a guaranteed path to riches? Not necessarily. But for those willing to invest time, skill, and strategic thinking, it offers genuine earning potential within a vibrant and ever-evolving metaverse.

Remember, it’s not just about “playing to earn”; it’s about building a sustainable future within a thriving play-to-own ecosystem.

Ready to embark on your Axie adventure? Dive into the following sections for detailed strategies, helpful resources, and cautionary tales from experienced players.

Let’s build something truly epic together, brick by digital brick, in the heart of Axie Infinity’s metaverse!

Axie Academy: Leveling Up Your Play-to-Earn Prowess

Now that we’ve debunked the myths and ignited your inner Axie adventurer, let’s get down to the nitty-gritty: how to actually earn in this blockchain playground.

Think of this as your Axie Academy crash course, equipping you with the knowledge and strategies to turn virtual battles into real-world rewards.

Mastering the Battle Arena:

- Team Synergy: Don’t just assemble a motley crew – build a cohesive team around complementary Axie classes and abilities. Research, experiment, and discover combos that dominate the battlefield.

- Daily Grind, Smart Grind: Yes, there’s an element of daily tasks and repetitive battles. But optimize your routine! Focus on high-reward activities, utilize energy efficiently, and avoid mindlessly grinding away your enthusiasm.

- Practice Makes Perfect: Hone your battle skills against other players, analyze mistakes, and learn from seasoned trainers. Remember, victory favors the prepared, not just the lucky.

Breeding for Profit:

- Understanding Axie Genes: It’s not just about aesthetics! Delve into gene combinations, traits, and recessive genes to breed Axies with high market value and battle prowess.

- Scholarship Star Power: Don’t underestimate the scholarship market. Breed Axies specifically tailored for scholar play, then offer them to aspiring trainers in exchange for a cut of their earnings.

- Trendspotting and Market Savvy: Stay ahead of the curve! Analyze Axie trends, identify in-demand traits, and breed Axies that fill the market gap – then watch your profits soar.

Beyond the Battlefield: Alternative Earning Avenues

- Land Ownership: From Baron to Tycoon: Invest in a slice of Lunacia, Axie’s virtual land. Build structures, harvest resources, host events, and rent out your land to fellow players for a steady stream of in-game currency.

- Content Creation: Axie Evangelist Extraordinaire: Share your Axie expertise through guides, streams, tutorials, and even artistic creations. Build a loyal community, attract sponsorships, and cash in on your content mastery.

- Community Building: Guild Mastermind: Forge alliances, create guilds, and organize tournaments. Facilitate collaboration, offer training to newcomers, and leverage your guild’s reputation to unlock lucrative partnerships and community-driven rewards.

Remember, this is just a roadmap, not a rigid itinerary. Experiment, discover your niche, and find what fuels your earning engine within the Axie ecosystem.

Navigating the Terrain: Tips and Resources for Aspiring Axie Earners

Scholarship Essentials:

- Finding the Right Axies: Choose Axies with balanced stats, easy-to-learn playstyles, and breeding potential to attract scholars.

- Crafting a Fair Contract: Clearly outline expectations, reward percentages, and dispute resolution mechanisms to ensure a smooth and mutually beneficial partnership.

- Community Matters: Join Axie scholarship communities, network with experienced trainers, and seek advice on building a successful program.

Avoiding Common Pitfalls:

- Don’t Chase Hype: Resist the temptation to buy into overhyped trends or Axies promising overnight riches. Stick to research, market analysis, and long-term strategies.

- Beware of Scams: The blockchain world is rife with scams. Stay vigilant, double-check contract terms, and never invest more than you can afford to lose.

- Remember, It’s a Game: Don’t get so caught up in earning that you forget to have fun! Axie Infinity is a vibrant community, filled with exciting gameplay, creative adventures, and genuine connections.

Beyond the Pixelated Curtain: Real-World Considerations

Tax Implications:

Understand the tax regulations surrounding cryptocurrency earnings in your region. Consulting a financial advisor is always recommended.

Time Investment vs. Reward:

Earning in Axie Infinity requires dedication and consistent effort. Be realistic about the time commitment and weigh it against your expected returns.

Sustainable Play-to-Earn:

Treat Axie Infinity as a long-term endeavor, not a quick buck scheme. Build sustainable earning strategies, diversify your income streams, and adapt to the ever-evolving metaverse.

Remember, your Axie journey is just beginning. We’ve equipped you with the tools and knowledge, but the path forward is yours to forge. Embrace the challenges, celebrate the victories, and above all, have fun exploring the boundless possibilities of Axie Infinity’s metaverse.

Q1: Is Axie Infinity too late to invest in?

That’s a crucial question, and the answer depends on your investment goals and risk tolerance.

Axie Infinity has indeed seen tremendous growth, and some highly valued Axies have reached astronomical prices. However, entry costs at that level might not be sustainable for everyone.

Here’s the nuance:

- Early adopter advantage: While some of the initial explosive growth might be behind us, there’s still potential for value appreciation and earning opportunities within the Axie ecosystem. Land ownership, scholarships, and community-driven initiatives present new avenues for involvement.

- Evolving landscape: The play-to-earn landscape is constantly shifting, with new games and platforms emerging. Diversifying your portfolio across play-to-earn options alongside Axie Infinity can mitigate risk and potentially unlock broader earning potential.

- Time investment vs. reward: Remember, Axie Infinity isn’t a passive income machine. Be realistic about the time commitment required to learn, strategize, and actively participate in the economy to see substantial returns.

Ultimately, the decision is yours. Consider your financial situation, risk tolerance, and desired level of involvement before making any investment decisions.

Remember, thorough research and a long-term perspective are key to navigating the ever-evolving world of play-to-earn.

Q2: Can I really earn a living playing Axie Infinity?

It’s possible, but not guaranteed. Several factors influence your earning potential, including:

- Skill level: Mastering team synergies, breeding strategies, and efficient gameplay tactics significantly increases your earnings potential.

- Time commitment: The more hours you dedicate to daily tasks, battles, and market analysis, the higher your potential yield.

- Chosen earning avenue: Axies with high battle prowess will generate more income through Arena rewards, while scholarships and market-savvy breeding can also be lucrative.

- Market fluctuations: Cryptocurrency prices are volatile, so your earnings may fluctuate alongside the overall market trends.

Remember, Axie Infinity is a competitive environment. Treat it like any other career path – dedication, skill development, and strategic thinking are crucial for success.

Don’t solely rely on Axie Infinity for your livelihood, but consider it as one income stream within a diversified portfolio.

Q3: Are there risks involved in playing Axie Infinity?

Absolutely. Here are some key risks to consider:

- Investment risk: The value of Axies and cryptocurrency can fluctuate significantly, leading to potential financial losses.

- Scams and phishing: The blockchain world is prone to scams. Always exercise caution, double-check transactions, and never share sensitive information.

- Technical glitches and platform vulnerabilities: Blockchain platforms are still evolving, and technical issues can temporarily disrupt gameplay or impact your assets.

- Tax implications: Depending on your location, cryptocurrency earnings may be subject to taxes. Consult a financial advisor for guidance.

Mitigate these risks through prudent financial planning, thorough research, and responsible participation within the Axie community.

Q4: What resources can I use to learn more about Axie Infinity?

Several excellent resources are available to help you navigate the Axie Infinity ecosystem:

- The official Axie Infinity website: This site provides comprehensive information on gameplay, economics, and official updates.

- The Axie Infinity community forums: Connect with experienced players, ask questions, and learn from their expertise.

- Educational YouTube channels and online guides: Numerous channels and websites offer in-depth tutorials, strategies, and market analyses.

- Social media communities: Follow Axie Infinity and dedicated player communities on Twitter, Discord, and Telegram for the latest news and discussions.

Stay informed, stay engaged, and don’t hesitate to seek help from the supportive Axie community.

Q5: What’s the future of Axie Infinity and play-to-earn?

The future is brimming with possibilities! Here are some exciting trends to watch:

- Expanding metaverse ecosystems: Axie Infinity is likely to integrate with other blockchain games and platforms, creating a more interconnected and diverse metaverse experience.

- New earning models: Play-to-earn is evolving beyond just games. Look for innovative applications in sectors like music, art, and social experiences.

- Focus on sustainability: As play-to-earn matures, expect increased emphasis on long-term economic models, resource management, and community-driven governance.

The play-to-earn landscape is still in its early stages, brimming with innovation and potential. Embrace the possibilities, contribute to the community, and be a part of shaping the future of this exciting new frontier.

This concludes our comprehensive guide to navigating the Axie Infinity metaverse and unlocking its earning potential. Remember, the journey is as important as the destination. Enjoy the adventure, fellow Axie adventurer!

P.S.: Your Personal Axie Odyssey

Beyond the strategies and resources, remember, this Axie adventure is ultimately yours to own.

It’s not just about maximizing earnings; it’s about exploring, connecting, and forging your unique path within this vibrant digital world.

Here are some ways to personalize your Axie experience:

- Discover your passion: Go beyond the meta trends and find what sets your Axie spirit ablaze. Maybe it’s crafting the ultimate battle team, breeding prized Axies with distinct aesthetics, or building a thriving community within Lunacia.

- Embrace the creative canvas: Axie Infinity isn’t just about battling; it’s a platform for creative expression. Design elaborate Axie homes, host in-game events, or even craft Axie-inspired art and share it with the community.

- Forge meaningful connections: The Axie community is more than just fellow players; it’s a network of passionate individuals eager to collaborate, share knowledge, and build lasting friendships. Participate in community events, join guilds, and mentor newcomers – you’ll be surprised by the rewarding relationships you form.

- Contribute to the ecosystem: Don’t just be a passive participant; become an active contributor to the Axie world. Share your strategies, offer constructive feedback, and participate in governance proposals to shape the future of the metaverse.

Remember, your Axie journey is as unique as the Axie you breed. Embrace the possibilities, explore with an open mind, and leave your mark on this ever-evolving digital frontier.

Let your Axie spirit guide you, and who knows, perhaps you’ll become the next legendary Axie trainer, inspiring others with your own path to success and fulfillment within the metaverse.

With that, we bid you farewell, fellow adventurer. May your Axie journey be filled with thrilling battles, rewarding earnings, and lasting memories in the heart of the Axie Infinity metaverse!

Verified Source References:

- Axie Infinity Whitepaper: https://whitepaper.axieinfinity.com/

- Axie Infinity Blog: https://axieinfinity.com/

- Play to Earn Alliance: https://www.playtoearn.online/

- Cointelegraph: https://cointelegraph.com/tags/axie-infinity

- Forbes: https://www.forbes.com/sites/youngjoseph/2021/10/06/metaverse-heats-up-how-axie-infinitys-30b-valuation-led-crypto-game-frenzy/

Artifiсiаl Intelligenсe

Blockchain: A Comprehensive Guide to Decoding the Revolutionary Technology

-

Education2 years ago

Education2 years agoCreating Engaging And Relevant Content As A Literacy Influencer

-

Internet3 years ago

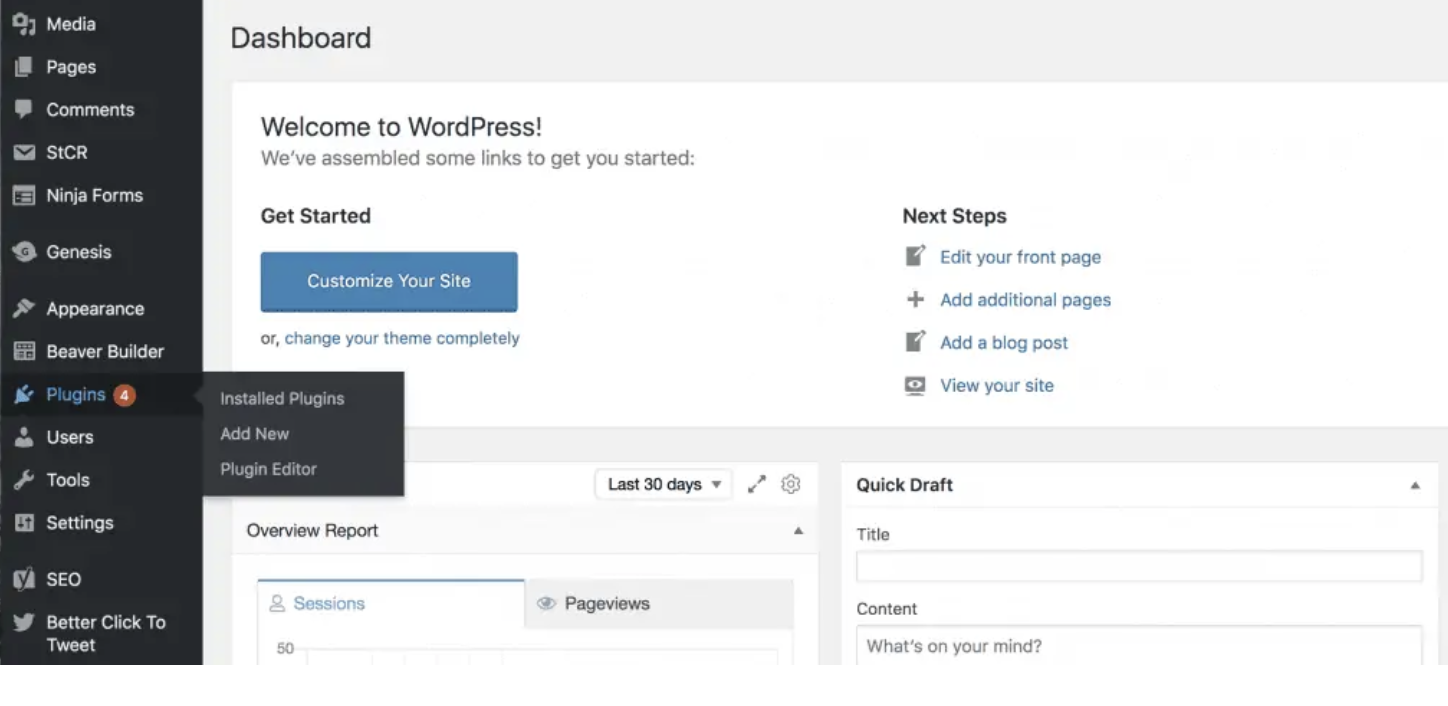

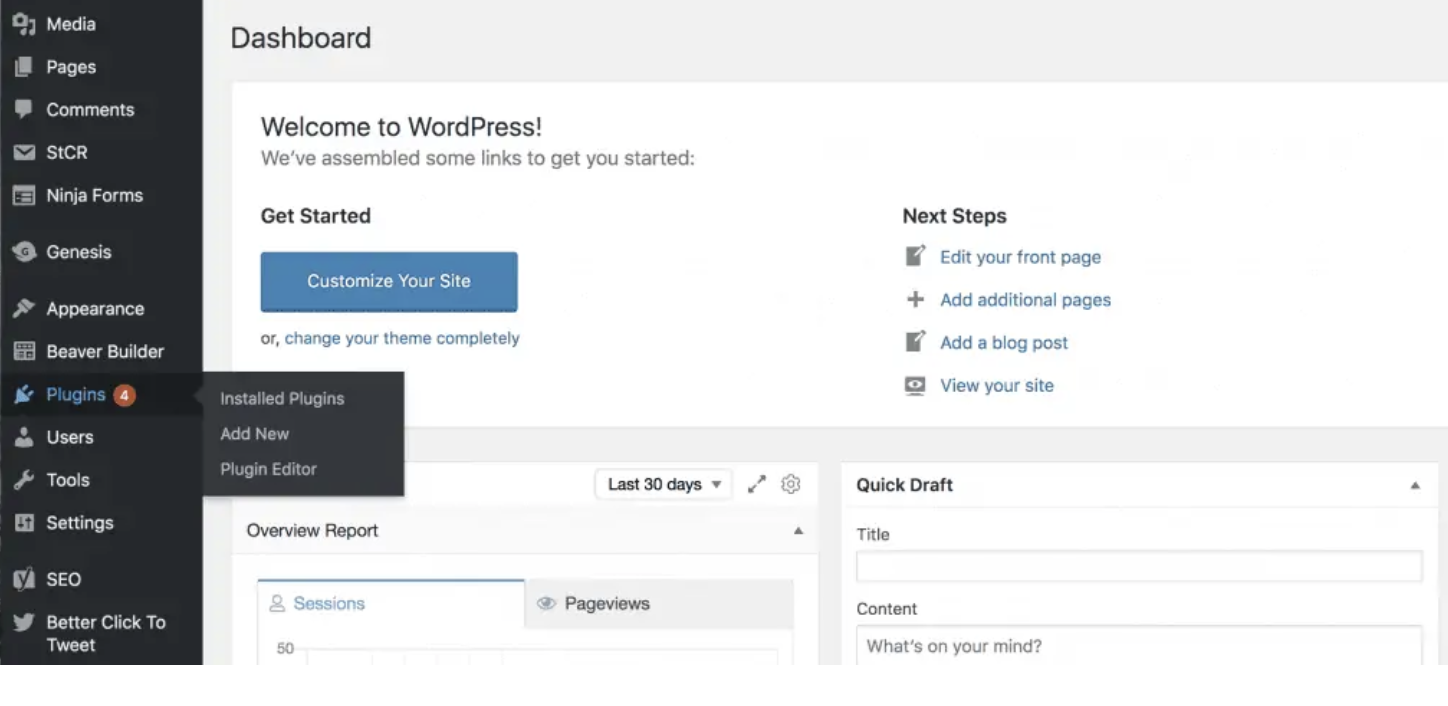

Internet3 years agoWhat Are the Differences Between WP Rocket, RocketCDN and Cloudflare

-

How To..3 years ago

How To..3 years agoWhat Is Better Than Safety Deposit Box

-

Mobile Phones3 years ago

Mobile Phones3 years agoKnow About the New Upcoming Mobile Phones

-

SEO2 years ago

SEO2 years agoWordPress: How to Fix ‘Add New Plugin Menu Not Showing

-

Software2 years ago

Software2 years agoWhy is Content Workflow Software Necessary for Content Production

-

Digital Marketing1 year ago

Digital Marketing1 year ago13 Possible Reasons Why Your Google Ads Are Not Showing Up

-

TVs2 years ago

All You Need to Know About the Toman Tokyo Revengers